Objectives

By the end of the topic, the learner should be able to:

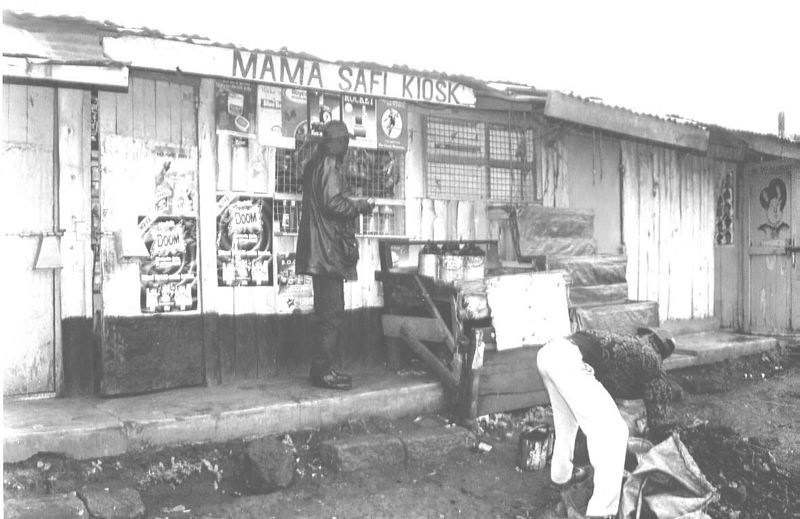

- Identify various forms of business units.

- Explain characteristics of each form of unit.

- Discuss management and formation of each form of business unit.

- Discuss sources of capital for each form of business unit.

- Discuss the role of the stock exchange as a market for securities.

- Explain advantages and disadvantages of each form of business unit.

- Recognise the circumstances under which the various forms of business units may be dissolved.

- Discuss trends in business ownership.